The Sustainable Finance Disclosure Regulation: the latest piece in the puzzle

Published on 18th November 2021

New draft regulatory technical standards on taxonomy-related product disclosures

On 22 October 2021, the European Securities and Markets Authority (along with the other European Supervisory Authorities (ESAs)) issued draft Regulatory Technical Standards (RTS) on taxonomy-related product disclosures under the EU's Sustainable Finance Disclosure Regulation (SFDR). The draft RTS amends the existing SFDR RTS. This aligns with the ESAs' desire to create a "single rulebook" for sustainability disclosures.

Where are we on the SFDR?

The SFDR came into effect in March 2021. However, the detail on how to comply with the primary obligations in the SFDR are set out in the SFDR RTS – this remains in draft and its implementation is set for July 2022.

The SFDR contains entity (or firm) level obligations and product (or fund) level obligations. This latest draft RTS updates the product disclosures (that is, fund-level pre-contractual, periodic and website disclosures) required for Article 9 and Article 8 funds that make sustainable investments with an environmental objective.

What are 'sustainable investments' under SFDR?

The SFDR defines a sustainable investment as an investment in an economic activity that contributes to an environmental or social objective, provided that the investment does not significantly harm those objectives and the investee entity follows good governance practices.

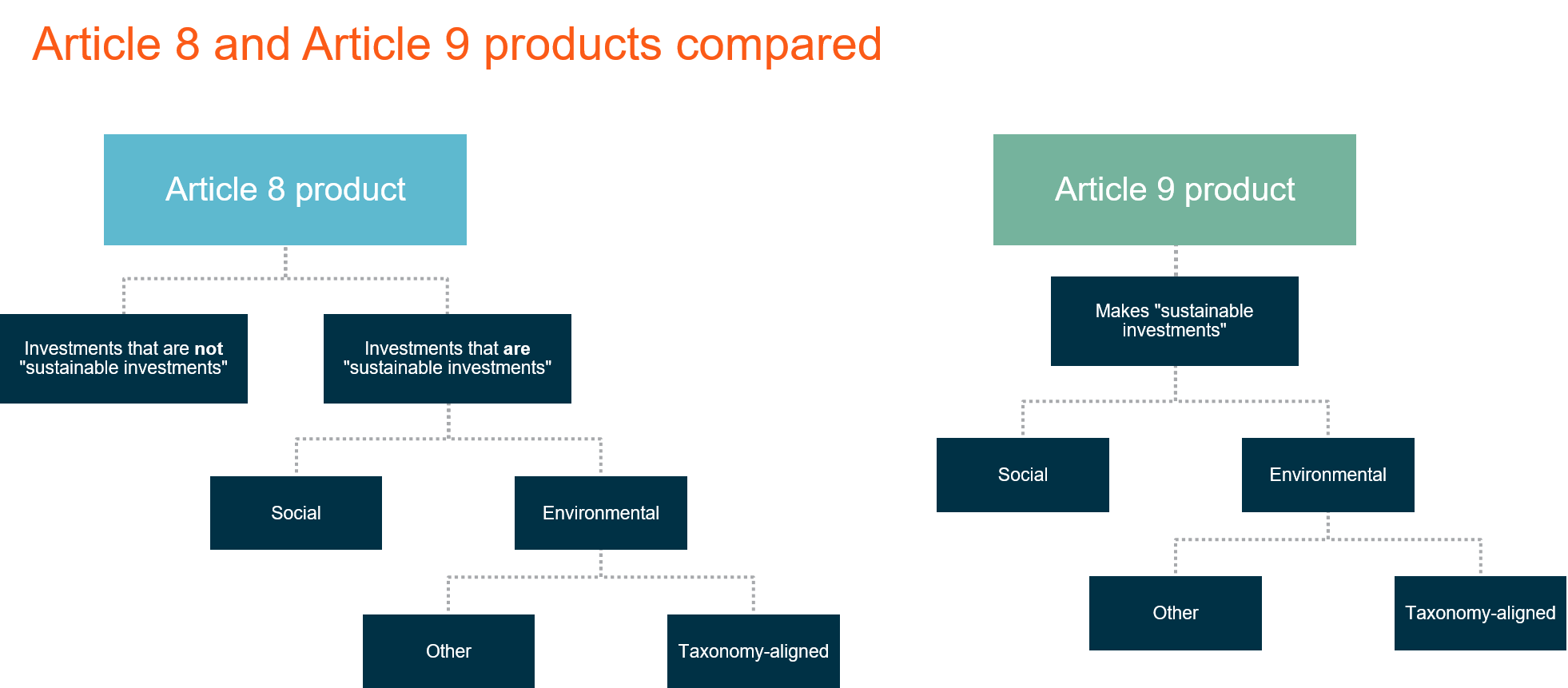

Under the SFDR, Article 9 funds have sustainable investment objectives and therefore make "sustainable investments" (although they may also invest in hedging liquidity instruments that fit the fund's overall sustainable investment objective).

Article 8 funds promote environmental or social characteristics. Article 8 funds may (but, in contrast to Article 9 funds, are not required to) make sustainable investments.

Where Article 9 and Article 8 funds make sustainable investments with an environmental objective, then Articles 5 and 6 (respectively) of the Taxonomy Regulation (TR) requires additional disclosure on the extent to which these investments are aligned with the TR (taxonomy-aligned). This categorisation is depicted below.

Summary of key changes

The RTS confirms the following:

- Allocation of sustainable investments: for sustainable investments, there needs to be a disclosure specifying the percentage which have an environmental objective and the percentage which have a social objective. This applies to both pre-contractual and periodic disclosures. Recital 8 of the RTS acknowledges that the proportions stated in pre-contractual disclosures are targeted. Nevertheless, this disclosure will be difficult for closed-ended private investment funds as the asset allocation will not be known during the fundraising stage.

- Disclosure on the extent of taxonomy-alignment: Article 9 and Article 8 funds that make sustainable investments with an environmental objective will need to disclose the TR environmental objectives to which the investments contribute. There also needs to be a disclosure on the extent to which the fund's investments are taxonomy-aligned: this will be in the form of a pie chart with the numerator being the market value of investments in investee companies that represents the proportion of taxonomy-aligned economic activities of those investee companies. Derivative exposures should not be included in the numerator. Two calculations should be produced: one which includes exposure to sovereign bonds in both the numerator and denominator and one which excludes such exposure. Disclosure on the extent to which the investments are taxonomy-aligned applies to both pre-contractual and periodic disclosures. For the pre-contractual disclosures, the extent to which the fund's investments will be taxonomy-aligned should be viewed as a target.

- Key performance indicators: for pre-contractual disclosures, one KPI (out of turnover, capital expenditure and operating expenditure) should be selected to make the calculation and disclosure in relation to investments in non-financial undertakings (with turnover being the default KPI). For periodic reports, all three KPIs should be used and reported.

- DNSH disclosure for taxonomy-aligned investments: the "do no significant harm" (DNSH) disclosure will apply to all sustainable investments, including taxonomy-aligned investments. The ESAs had previously considered that the DNSH disclosure should not apply to taxonomy-aligned investments as these also need to comply with the technical screening criteria set out in the TR.

Next steps

The Commission will scrutinise the RTS and decide whether to endorse it within three months of its publication. The Commission intends to incorporate all the SFDR RTS (those originally submitted to the Commission in February 2021, together with those discussed here) in one instrument. Disclosure requirements under the TR relating to the climate mitigation and adaptation objectives start to apply from 1 January 2022, while the SFDR RTS have an expected application date of 1 July 2022.