A brave new world: UK real estate funds and the new non-resident capital gains tax on UK land

Published on 11th July 2019

April 2019 saw the introduction of a new regime taxing non-residents on gains on the direct and indirect disposal of interests in UK land and buildings. This new regime is the latest step in a series of changes over the past few years that have brought non-residents into the UK tax net (see our previous Insight for more on the background). The move reflects a desire by the UK tax authorities to have a level playing field between residents and non-residents.

What does it mean?

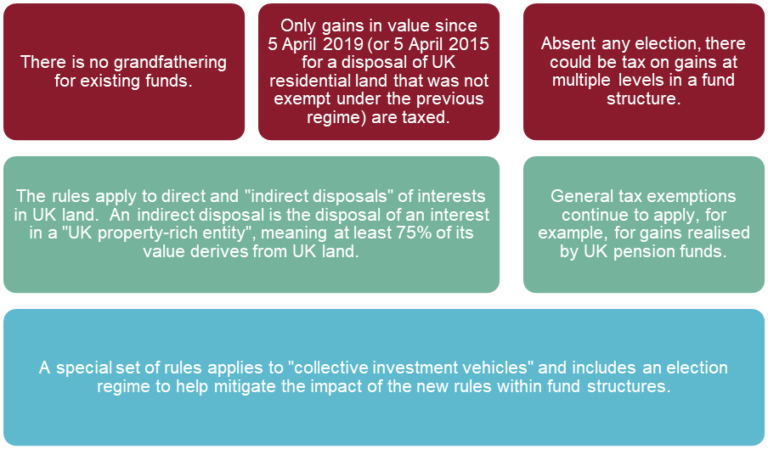

The new rules apply to non-resident individuals and other entities (such as companies or trusts) and impose UK tax on investment gains arising from a direct or indirect disposal of UK land and buildings on or after 6 April 2019. The rules apply to both commercial and residential land and replace the previous charging regime for certain non-UK residents holding UK residential land.

The key points to note on the application of the new rules to fund structures are as follows:

Mitigation measures

When the proposals were announced, concerns were raised in the fund industry that the indirect disposals provisions would result in multiple layers of taxation for typical fund structures.

The government listened and has introduced:

- a special set of rules applying to Collective investment vehicles (CIVs) (as defined within the new rules and broadly made up of collective investments schemes, alternative investment funds, REITs and non-UK resident companies which are REIT like equivalents); and

- an election regime, the aim of which is to remove tax leakage within a fund structure, so that in many cases tax arises only at investor level and tax-exempt institutional investors are not prejudiced by the new rules.

The special rules treat CIVs that are not partnerships as companies for the purposes of the rules. This means that, subject to making an election, gains realised by the CIV will be taxable within the CIV. For example, if a JPUT sells a property, it will be subject to UK tax on gains arising. There are two elections potentially available to mitigate that tax charge.

A Transparency Election is available to offshore CIVs that are transparent for income, which treats the CIV as a partnership for all capital gains purposes. This means that gains arising on disposals by the CIV will be taxed directly on the investors in it, who will need to file returns on the basis of such disposals.

To be valid, the election must be made within twelve months of the CIV first acquiring an interest in UK land or a UK property-rich entity (or before 5 April 2020 for existing funds). Once made, the election cannot be revoked. Due to the impact it has on investors, a transparency election can only be made by the manager if all investors consent.

An Exemption Election can be made by certain CIVs and certain co-ownership authorised contractual schemes and results in exemption from UK tax on capital gains within the fund (but not for any other tax purposes), provided the fund manager complies with certain ongoing reporting obligations.

The election is only available if certain conditions are (and remain) fulfilled. The conditions are designed to ensure that the election can only be made where HMRC believes it is appropriate to do so: for example, where the fund meets a genuine diversity of ownership test.

The conditions will need careful attention to determine whether they are, and can remain, fulfilled. The exemption election can be made at any time (assuming the conditions are fulfilled) and can be backdated by up to twelve months. The exemption election does not prevent a tax charge arising for non-resident investors disposing of their interests in the elected CIV.

Draft election forms have recently been released by HMRC.

What has not changed?

- These new rules only affect the tax treatment of capital gains. There is no change under the new rules to the tax treatment of income from UK land.

- The new rules do not change the tax treatment of partnerships, which are still treated as tax transparent for the purposes of chargeable gains.

- The new rules also do not change the position for UK tax resident investors, who remain liable to UK tax on all income and gains.

- All existing exemptions apply to gains arising, such as an exemption for qualifying pension funds, or sovereign exemptions.

Osborne Clarke comment

The new rules are a game-changer for UK real estate funds, but in many ways bring the UK into line with many other jurisdictions worldwide in taxing indirect disposals of land. However, the impact of the changes on fund structures has been mitigated due to the election regime that has been introduced.

Fund managers will need to think carefully about whether they should make an election, and if so, which one will work best for their structure and investor group. They will also need to check what information they need to collect and are able to share as part of the election reporting regime.

There may be relief available to investors under an applicable double tax treaty, although many UK treaties recognise the UK's right to tax gains on UK land and there are anti-avoidance rules in place that will override any structuring aimed at exploiting those jurisdictions that currently have a favourable treaty in place.

It will be important to establish the base cost of the interests in the fund and in the underlying assets at 5 April 2019 as only gains after this date will be taxed under the new rules.