LIBOR transition: will a daily compounded SONIA index unlock the use of the sterling risk-free rate?

Published on 25th June 2020

The Bank of England has published its response to feedback on its intention to produce a compounded SONIA index. In this article, we examine this important milestone on the road to the adoption of risk-free rates.

Regulators of the financial sector have continued to hold an undiminished focus on the cessation of LIBOR irrespective of the change and disruption caused by the coronavirus pandemic. The Financial Conduct Authority, the Bank of England and the Working Group on Sterling Risk-Free Rates (the RFRWG) have been keen to stress that the central assumption that firms cannot rely on LIBOR being published after the end of 2021 has not changed. However, the recommended timings for some of the steps in the transition to a LIBOR-free world have been relaxed.

Where are we heading?

The RFRWG's present recommendations are as follows.

- By the end of the third quarter of 2020 lenders should be in a position to offer non-LIBOR linked-products to their customers.

- After the end of the third quarter of 2020, clear contractual arrangements should be included in all new and refinanced LIBOR-referencing loans to facilitate conversion ahead of the end of 2021, through pre-agreed conversion terms or an agreed process for renegotiation, to SONIA or other alternatives.

- No new sterling LIBOR-referencing loan products that expire after the end of 2021 should be issued after the end of the first quarter of 2021.

While some may welcome the relaxation of the proposed timings, many have already started to embrace a LIBOR-free future and are looking to execute loans referencing SONIA (Sterling Overnight Index Average) and other risk-free rates.

Evidence of the progress made to date can be seen from the Loan Market Association's (the LMA) recently published list of transactions referencing risk-free rates and from the activities of our clients, among whom there is an increasing appetite to document loans referencing a risk-free rate.

The LMA's publication of exposure drafts of term and revolving facilities agreements referencing compounded SOFR (Secured Overnight Financing Rate) and compounded SONIA have, undoubtedly, added impetus to the transition to risk-free rates. The recent publication of the Bank of England's response to feedback received on its 26 February 2020 discussion paper will provide a further shot in the arm to the development of, and increase in, SONIA-referencing loan products.

Bank of England's discussion paper

The discussion paper sought views from sterling market participants on:

- the BoE's intention to publish a daily SONIA compounded index (the SONIA Index); and

- the usefulness of the BoE publishing a set of compounded SONIA period averages.

The paper explains that the SONIA Index would comprise a series of daily data representing the returns from a rolling unit of investment earning compounded interest each day at the SONIA rate. The starting value of that notional investment would be set at 1.0000000000 on 23 April 2018 (the date for which the central bank first published SONIA calculated using current methodology).

The SONIA Index would be calculated for each business day by making an incremental adjustment to the then prevailing value to reflect the additional compound interest that would be earned at that day's SONIA rate.

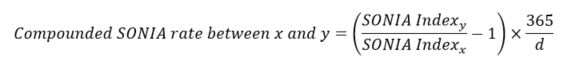

Knowing the SONIA Index for two dates enables the calculation of the compounded SONIA rate for the period which starts and ends with those dates. The formula for doing so is included in the discussion paper and set out below.

Where:

- x is the start date of the period;

- y is the end date of the period; and

- d is the number of calendar days in the period.

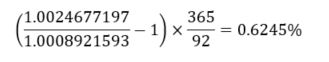

By way of example (using the illustrative series of SONIA Index data available on the BoE's website), for an observation period commencing on 4 July 2018 (for which the illustrative SONIA Index is 1.0008921593) and ending on 4 October 2018 (for which the illustrative SONIA Index is 1.0024677197), the compounded SONIA rate would be 0.6245%, applying the formula as below.

This provides a considerable degree of simplification over the calculation of the same rate by compounding SONIA for each business day in that period.

A SONIA period average refers simply to the SONIA rate for a given period: for example, one month, two months or three months. The publication of an appropriately weighted period average coinciding with the observation period for an interest period of a loan should enable the calculation of a SONIA-referencing interest rate to be no more complicated than the calculation of a LIBOR-referencing interest rate (the period average being a single figure, publicly available in the same manner as a LIBOR screen rate).

Feedback to the discussion paper and the BoE's response

On 11 June 2020, the BoE published a summary of, and its response to, the feedback received from sterling market participants.

Unsurprisingly, the paper notes there was near unanimous support among respondents for the bank producing the SONIA Index. In light of this, the BoE has announced that, from early August, it will publish the SONIA Index.

Responses on whether the bank should publish compounded SONIA period averages were, however, mixed. While a majority of respondents supported the BoE publishing such averages, the minority that opposed it doing so was sizeable and there was no discernible consensus around how such averages might be produced.

Noting this, the bank states that it will not produce SONIA period averages but that it would be willing to consider the issue again should views in the market converge in favour of the production of period averages and on the means by which they should be produced.

What should lenders conclude from these latest developments?

The BoE undertaking to publish the SONIA Index is clearly a helpful development – the availability of the index will enable lenders to calculate a SONIA-referencing interest rate through a significantly reduced number of data points, provide greater transparency as to how a rate is calculated and give borrowers reason to feel more confident that their interest rate has been properly calculated.

A note of caution is required, however. The SONIA Index is based on a prescribed methodology. If the terms of a given loan do not align with this methodology, it will not be appropriate to use the SONIA Index to calculate the interest rate for that loan. A loan for which interest is to be calculated on the basis of an 'observational lag' approach, rather than the 'observational shift' approach consistent with the SONIA Index, is the obvious example here.

There is clear utility in a lender being able to calculate interest by reference to the single figure that an appropriate period average would provide. The Bank of England's concerns around the lack of consensus should be well noted, however. The precipitative publication of period averages based on conventions that do not mirror those used in the loan markets might at best prove irrelevant and, at worst, actively inhibit the smooth transition to risk-free rates.

A methodology to allow for the use of the SONIA Index in calculating interest has been used for the revolving credit facilities provided to British American Tobacco (the facilities agreement for which was executed earlier this year and is available publicly). This may prove a helpful precedent for loan parties and their counsel in grappling with the practicalities of how to implement SONIA in loan documentation. It also provides an insight into how certain commercial points that have been left open by the LMA exposure drafts might be resolved. Certainly, we have seen some of these principles reflected in other risk-free rate loans.

We expect to see a significant uptake of SONIA-referencing loans in the coming months. Lenders and borrowers alike will want to ensure that any such loans adopt market-facing positions so as to not prejudice the transferability of that loan and to ensure consistency across their financing arrangements.