Crown preference in insolvencies: what is changing, and why does it matter

Published on 26th November 2020

On 1 December 2020 the Crown, in respect of certain taxes, will be promoted from ordinary unsecured creditor status to preferential creditor status in the insolvency distribution waterfall. That will have big consequences for secured and unsecured creditors, and could change stakeholder behaviours.

What is a preferential debt/creditor?

Certain unsecured claims rank in priority (or preferentially) to floating charge claims, the 'prescribed part' and general unsecured claims. Preferential claims include contributions to pension schemes, wages and salary (up to £800 per person), holiday pay, EU levies or surcharges, eligible deposits, and some ineligible deposits.

What is Crown preference?

Until 2003, when the Enterprise Act 2002 became law, HMRC was a preferential creditor in respect of taxes collected by businesses as agent ("Source Taxes"), specifically: VAT, PAYE, income tax, national insurance contributions, and Construction Scheme Industry deductions.

Those claims were capped at 6-12 months of arrears, depending on the Source Tax. Taxes that are not Source Taxes (because they are collected by HMRC direct, such as corporation tax) have, at least since 1986, been ordinary unsecured claims. Under the Enterprise Act, Crown preference was abolished, meaning that HMRC, in respect of Source Taxes, became a general unsecured creditor, ranking behind floating charge realisations. That was good for banks and for unsecured creditors.

What is the current position?

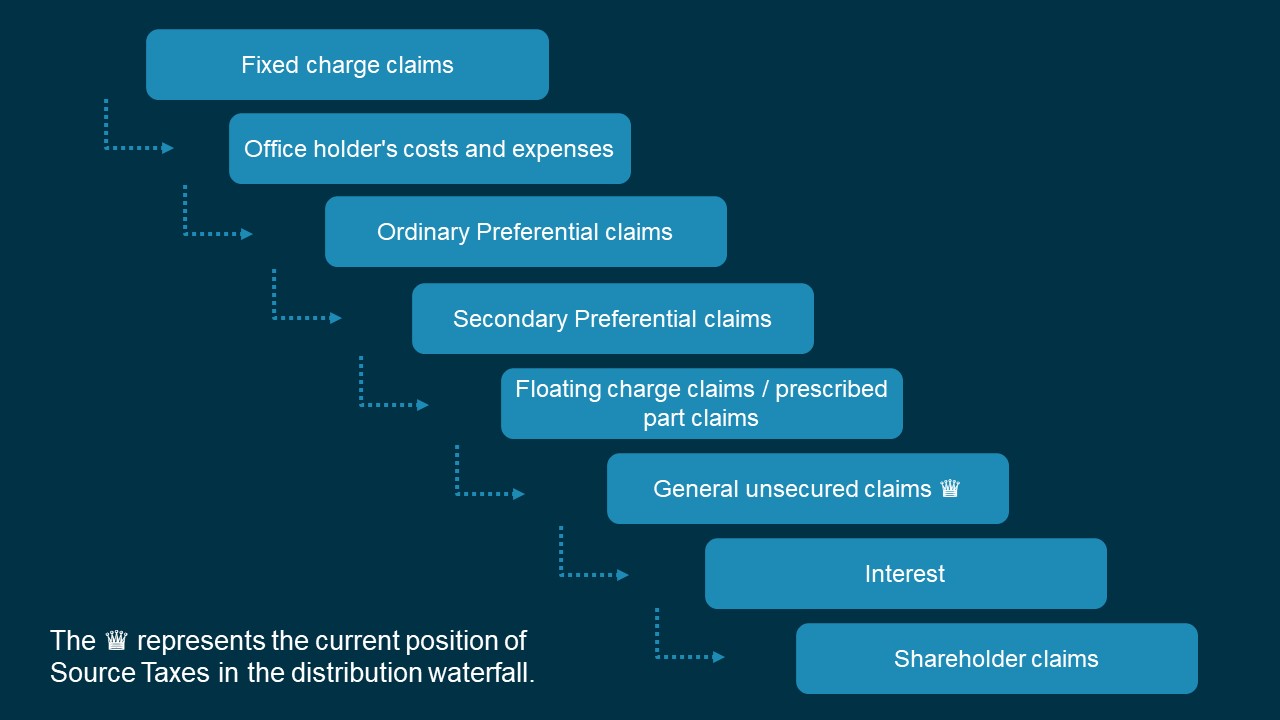

Currently, realisations in an administration or liquidation are distributed as follows. The ♛ represents the current position of Source Taxes in the distribution waterfall.

What is changing, and why?

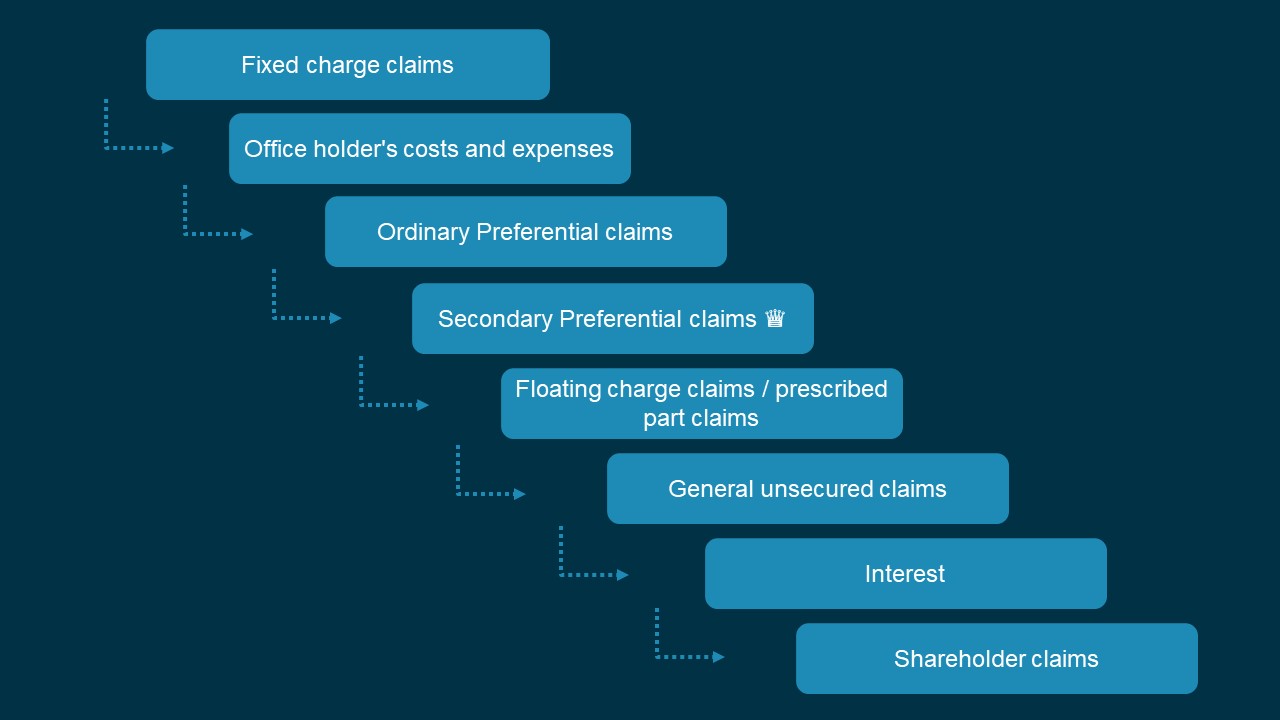

The Finance Act 2020 received Royal Assent in July, and will become law on 1 December 2020. It will restore HMRC as a preferential creditor in respect of Source Taxes, meaning that the distribution waterfall will look like this. The Crown jumps up the waterfall, ranking ahead of floating charge claims and unsecured claims.

There will be two principal differences to the Enterprise Act position:

- There will be no cap (in quantum, or in age of arrears) to the Source Taxes that can be collected as preferential debts.

- The Crown preference will coexist with the prescribed part. The creation of the prescribed part, from which HMRC also benefits, was one of the quid pro quos for the abolition of Crown preference.

The rationale for the change, as explained in the Finance Act, is that "when a business enters insolvency, more of the taxes paid in good faith by its employees and customers and temporarily held by the business go to fund public services rather than being distributed to other creditors". This is based on what is a probably a misconception: that the public at large would prefer realisations in an insolvency to augment the public purse, rather than pay ordinary unsecured creditors.

What will this mean in practice?

The change has been widely criticised. It will discourage enterprise and make insolvencies more likely because lenders will be less amenable to lending in the first place and less amenable to supporting distressed businesses in due course.

The change will also deprive unsecured creditors of realisations that they would otherwise receive and use to meet their own obligations to HMRC.

Another likely consequence is that it will become more difficult to get CVAs approved. A CVA cannot compromise preferential debts (without the creditor's consent), and so invariably those creditors must be paid in full, making the package less attractive to ordinary unsecured creditors.

Commentators argue that HMRC does not need this additional support. HMRC is in a better position than most creditors (secured or unsecured) to know the state of a business's finances, and it is a well-resourced institution with restructuring/insolvency experience. Moreover, HMRC has a number of tools at its disposal which it could use to protect tax debts.

Lenders provide credit based on detailed risk assessments, including considering their likely recoveries in the event of enforcement and/or insolvency. Lending decisions typically assume a certain recovery from floating charge realisations. Those recoveries will now be substantially reduced and, because there is no cap on Source Taxes recoveries, that potential loss cannot be easily priced. This could have three consequences.

- A rush to enforce before 1 December 2020, thus avoiding Source Taxes leakage (we have already seen that on a number of cases).

- More restrictive lending criteria and/or higher interest rates/lender fees going forward.

- Lenders being required to carry out extensive diligence before committing funding to get clarity on a borrower's historical tax affairs.

While the restoration of the Crown preference will only apply to cases from 1 December 2020, it is retrospective in that it will apply to secured lending already in place.

Comment

This is a significant change, and not a particularly popular one. Coming at a time when more businesses will find themselves as unsecured creditors in insolvency situations, or will be struggling themselves, the impact could be particularly pronounced.

If you would like more information about what this change means for your business, please get in touch with your usual Osborne Clarke contact.