Income Strips: de-risking the deal

Published on 4th July 2017

With a wall of money looking for a return on investment, what is there not to like about an income strip deal offering long term income – typically 35 years or more based on 5 yearly indexed reviews capped and collared at 4% and 0% respectively? These attractive returns are encouraging funds to enter into income strip transactions despite the development risks they entail.

What is an income strip deal?

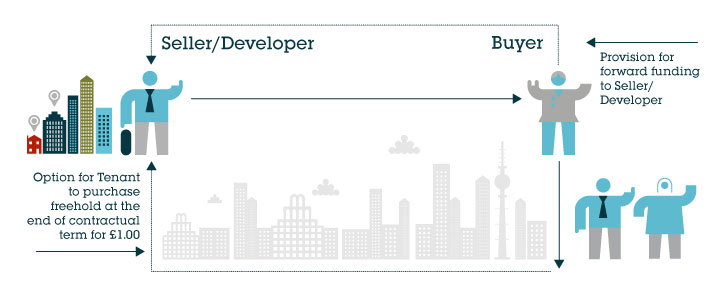

Income strip deals are, in essence, forward funding arrangements to acquire property assets which are then typically sold back to the occupier for a £1 at the end of the lease. The structure works with a range of assets, although it readily lends itself to student accommodation.

In its simplest form an income strip deal can look like this:

A typical forward funding arrangement under an income strip deal – acquiring the land up front and then funding the construction – is not without risk, but as a result these deals will typically attract a higher yield than one that could be obtained from buying existing standing stock.

Balancing the competing interests of investors and developers

From an investor’s perspective the key is as far as possible, to de-risk the deal, while from a developer’s point of view more comfort may have to be given to guarantee performance and income. Here are some key points for both investors and developers to consider:

- Developer/contractor failure – Financial due diligence and established track records are key to the investor and the developer may have to think about doing more than just the normal approach of dropping the development into an SPV. Full step in rights for construction and funding agreements coupled with contractor performance bonds and/or guarantees are essential if a developer wants to make the investor comfortable here.

- Cost overruns – A maximum financial commitment from the investor ensures that the developer bears the risk of all cost overruns but full due diligence into the appraisal and sight of the signed building contract is needed to check the accuracy of the overrun figure. For certainty on cost on both sides the parties will want to see the building contract signed at the same time as the funding agreement.

- Pre-let-the property – The building must be fully let. While the rent will typically be linked to practical completion, the investor should ensure that the rent is not capable of being reduced in circumstances where it is linked to a development out turn, such as the number of rooms or floor area provided. Often the agreement for lease is signed ahead of involvement by the investor and so the developer should avoid conceding any form of tolerances on rent.

- Secure rental income – Good financial covenant strength of the tenant backed by a non-assignable lease can be balanced in lease negotiations by some flexibility in the subletting provisions and a more relaxed investor approach to alterations.

- Tenant insolvency – Whilst the income is of primary importance, consideration should still be given to the attractiveness of the property to other occupiers should the tenant become insolvent.

Osborne Clarke comment

A good supply of potential schemes (although popular with student accommodation the income strip structure lends itself to hotels and even pubs), combined with strategies for the mitigation of development risk and the availability of tenants of sound financial standing, is likely to continue to drive the increasing popularity of these deals . However, investors will be naturally cautious so developers have a role to play in packaging up deals to address those concerns.

The Real Estate team at Osborne Clarke have acted on a number of income strip deals (acting for both investors and developers) and seen a steady increase in these deals over the past few years.

For further information on this topic, please contact our experts.