Reforms to the director liability regime under the new Belgian Code on Company and Associations

Published on 7th Dec 2018

The new Code on Companies and Associations ("BCCA") is here. The Code on Companies and Associations entered into force on 1 May 2019 and has major implications for businesses. In this article, we will focus on how the BCCA impacts the liabilities of director.

As noted in the explanatory notes (Memorie van Toelichting/Exposé des Motifs) to the proposed BCCA, the chances of being held liable as a director are much higher in Belgium compared to neighbouring countries. A thorough reform with regard to directors’ liability was therefore a substantial part of the reform.

The key changes to the director liabilities regime are as follows:

One System

The BCCA introduces a common liability regime for all types of companies and associations, based on the existing regime for public limited liability companies (SA/NV), with some modifications.

Liability for the de facto director

The same liability regime applies to “de facto directors”, i.e. any person that exercises the tasks and carry out the responsibilities of a director without being formally appointed.

Joint liability as default liability

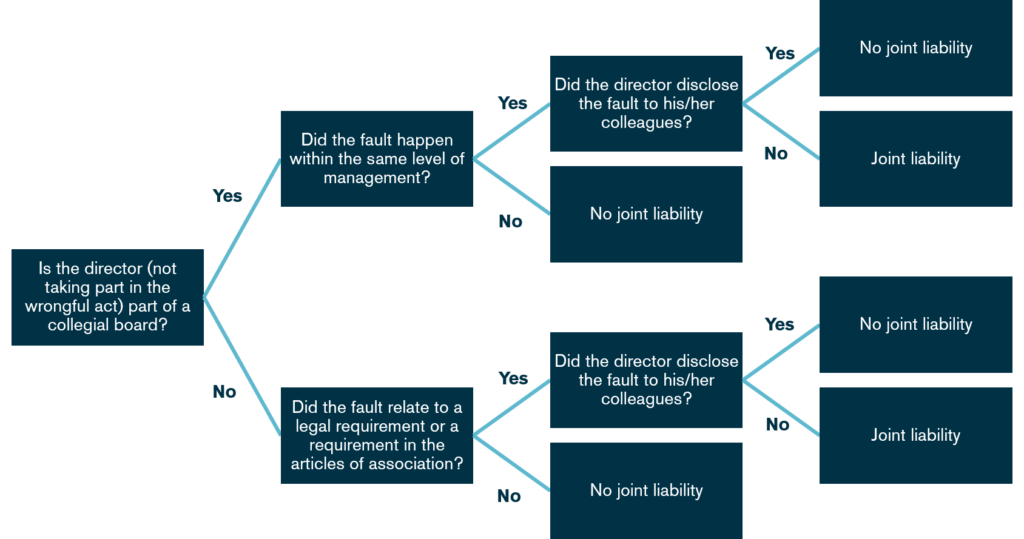

With the introduction of the BCCA, directors are, by default, jointly liable for all management and surveillance faults if they are collegially organised or if they relate to a violation of the BCCA or the Articles of Association (AoA). Previously, directors were individually liable for personally committed faults, liable in solidum for damage resulting from concurring faults committed by different directors, and jointly and severally liable if the damage was triggered by a joint fault. If they violated the AoA or the Belgian Companies Code, directors were held jointly and severally liable.)

The diagram below sets out how the liability analysis applies in practice. This liability can always be invoked by the company, but can only be invoked by a third party when they relate to a violation of the BCCA or the AoA.

Capped liability

- Director’s liability is now capped vis-à-vis the company/association and third parties at:

- EUR 125,000 for very small companies/associations with an average balance sheet total not exceeding EUR 175,000, and an average annual turnover (excluding VAT) below EUR 350,000;

- EUR 250,000 for small companies/associations with an average balance sheet total not exceeding EUR 350,000, and an average annual turnover (excluding VAT) below EUR 700,000; and

- EUR 1,000,000 for companies/associations not falling under 1) and 2) and having not exceeded more than one of the two following thresholds : (i) an average balance sheet total : EUR 4,500,000 ; (ii) an average annual turnover (excluding VAT): EUR 9,000,000;

- EUR 3,000,000 for companies/associations not falling under 1), 2) and 3) with an average balance sheet total exceeding EUR 4,500,000, and an average annual turnover (excluding VAT) exceeding EUR 9,000,000, without having reached or exceeded an average balance sheet total of EUR 43,000,000 and an average annual turnover (excluding VAT) EUR 50,000,000;

- EUR 12,000,000 for large companies/associations not falling under 1), 2), 3) and 4) – having reached or exceeded at least one of the following thresholds : (i) an average balance sheet total EUR 43,000,000 ; (ii) an average annual turnover (excluding VAT) EUR 50,000,000.

The turnover and balance sheet total are calculated over the three financial years preceding the introduction of the action for damages or over the period since the incorporation if less than three financial years have passed since such incorporation.

- The cap is an aggregate cap that applies to all directors together and that is to be shared between all creditors/claimants. This cap is calculated with respect to a wrongful act or set of wrongful acts leading to liability, regardless of the number of creditors/claimants or actions.

- The cap applies to any type of liability, including proven negligence and criminal sanctions, but will not apply in case of repeated minor faults, gross negligence, fraudulent intent or intent to cause harm.Although parties cannot exclude the cap by contract, it applies only to directors' liability and not to contractual guarantees or other credit support provided by directors. Certain limitations apply regarding social security institutions. The cap does not apply in case the fault leads to bankruptcy.

- This new cap should facilitate enrolment in manageable and affordable D&O insurance.

No exemption/holding harmless

Large companies often exempt/hold their directors harmless for any liability in respect of their mandate. Currently, it is often unclear whether such an exemption/holding harmless guarantee is valid. The BCCA explicitly prohibits a company, its subsidiary or other entities it controls, from exempting directors against any liability in respect of their mandates or holding them (even partially) harmless in such respect. Any provision in the articles of association, in an agreement or by unilateral expression violating this principle will be deemed void The preparatory works to the BCCA do, however, clarify that third parties such as a parent company or shareholders of the company may hold directors of the company harmless.

Liability grounds

While pre-existing liability grounds remain unchanged, the BCCA formally introduces a description of the obligation of proper performance of duties by directors. As a result, directors can be held liable by the company when they do not properly fulfil the tasks assigned to them.

Limited power for judicial review

The BCCA codifies the limited power of judges to consider the discretionary acts of directors (contrôle marginal / marginale toetsing). Namely, directors can only be held liable for decisions, acts or conduct that are manifestly outside the margin within which prudent and careful directors, placed in the same circumstances, could reasonably agree.

Key take-aways for directors

- Provide the board of directors and/or other decision makers in your company with key insights in respect of the new framework for directors’ liability and discuss the impact on your organisation;

- Communicate transparently within the relevant board level and to the supervisory board (if applicable ), in writing, any acts that you consider wrong, not diligent, illegal or not in line with the articles of association or the BCCA;

- Consider revising your D&O liability insurance up to the amount of the cap and align any exclusion with the new framework. Update your insurer regularly if the balance sheet or annual turnover of your company increases.