Convertible notes: how shall the price per share upon capitalisation be calculated?

Published on 27th Nov 2023

Upon capitalisation of convertible loans or notes, the price per share shall be calculated by applying the discount to the price per share paid by the investors in the cash round. Applying the discount directly to the pre-money valuation implies benefiting from a lower discount

What are convertible loans?

Convertible loans, also referred to as "convertible notes", are loans granted by investors whose ultimate interest is to access a company's capital by capitalising the loans when certain milestones are met (in a venture-backed start-up, these milestones are likely to be the closing of a financing round or upon a liquidity event).

Start-ups frequently use convertible loans to finance their operations in a flexible manner, postponing some of the procedures that delay the closing of financing rounds (valuation of the company, due diligence, negotiation of the investment agreement and the shareholders' agreement, etc.). Convertibles are, therefore, used as bridge financing until the next round. Naturally, a lender who assumes a higher risk (by financing a less mature company) expects to be compensated with a higher return, or in other words, a better entry price in the company's capital.

This better price usually results from a discount on the "price of the round". However, this may be complemented by other mechanisms, such as capitalisation of interest or fixing a valuation cap upon conversion. Let's now move away from these concepts and focus on the application of the discount.

What is understood by 'price of the round'?

When agreeing on the terms of the convertible note, reference is often made to a discount on the "round price". This sometimes leads to the erroneous conclusion that the discount should be applied to the pre-money valuation agreed with the lead investor. The correct approach is to apply the discount to the price per share to be paid by the "round investors" (understood as those who participate in the round by investing through cash contributions).

The first approach (discount on the pre-money valuation) is missing a key point: the convertible note is part of the fully diluted share capital of the company and its economic value has already been taken into account in the pre-money valuation agreed with the round investors. The shares corresponding to the convertible's capitalisation only dilute the company's pre-existing shareholders, and do not affect the stake acquired by the round investors.

An investor contributing €2M at a pre-money valuation of €8M expects to receive 20% of the company, which, after the round's closing, will have a post-money valuation of €10M. If that company has €1M in convertible loans, these form part of the €8M agreed valuation and the existing shareholders will bear the dilution.

For more details on the concepts of "pre-money valuation" or "fully diluted capital", as well as on the calculation of the price in financing rounds, see our Insight.

How are the prices of the round calculated?

The round investors cannot suffer any dilution arising from the conversion of convertible notes and the price they will pay for each share is calculated by dividing the pre-money valuation by the number of shares into which the fully diluted share capital is divided (which include the convertibles).

But, how do we calculate the number of pre-money fully diluted shares, which must include the shares created through capitalisation of the convertible, if the price of those convertible shares depends in turn on the price of the shares to be created as part of the round?

The solution is to determine the economic value that the convertible notes represent in the fully diluted pre-money and then calculate the different entry prices:

Step 1: Calculate the economic value of the convertible note in the fully diluted share capital by determining the expected return on the convertible based on the agreed discount:

Economic value of the convertible = Convertible amount / (1 - discount %)

Step 2: Calculate the fully diluted equity value, net of the value of the convertible note:

Economic value of the fully diluted (without (convertible) = Premoney valuation - Economic value of the convertible)

Step 3: Calculate the price per share to be paid by the round investors (or the "price of the round"):

Price per share of the Round = (Economic value of the fully diluted (without convertible) / (number of shares fully diluted)

Step 4: Lastly, calculate the price per convertible share by applying the agreed discount to the price per share in the round:

Price per share of the convertible = Price per share of the Round x (1 - discount %)

Example

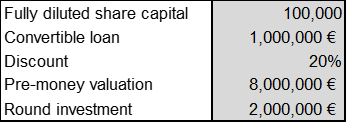

A company will receive an investment of €2M at a pre-money valuation of €8M. The company has a fully diluted share capital of 100,000 shares and has received convertible loans of €1M at a 20% discount on the price of the round.

Discount on the price per share: As shown in the following example, by applying the discount on the price per share of the round (by performing the calculations outlined above), the two objectives are met:

a) Convertible holders pay 20% less for their shares than round investors; and

b) the 29,630 shares created out of cash contributions (€2M) represent 20% of the fully diluted post-money share capital (valued at €10M).

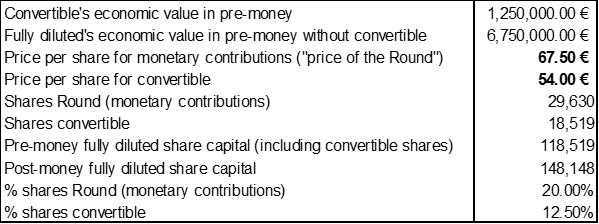

Discount on the pre-money valuation: Let's see what would have happened if we had calculated the entry price of the convertibles by applying the discount directly to the pre-money valuation:

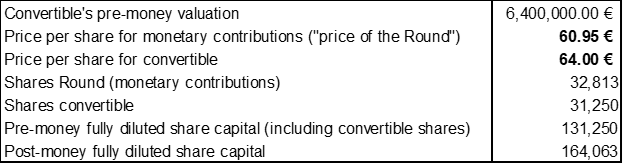

Applying a 20% discount to the pre-money valuation of €8M results in a pre-money valuation for convertible purposes of €6.4M. By dividing this amount by the 100,000 fully diluted shares, we obtain a price per convertible share of €64.

The loan is therefore converted into 15,625 shares, resulting from dividing the loan amount (€1M) by the price per share calculated in accordance with the previous paragraph (€64). After conversion, but prior to the round, the fully diluted capital is set at 115,625 shares. The price per share of the round is set at €69.19, resulting from dividing the pre-money valuation (€8M) by the fully diluted capital (115,625).

In this case, the 28,906 shares subscribed by the round investors still represent 20% of the post-money share capital, but the effective discount of the convertible note with respect to the round price has been reduced to 7.5%.

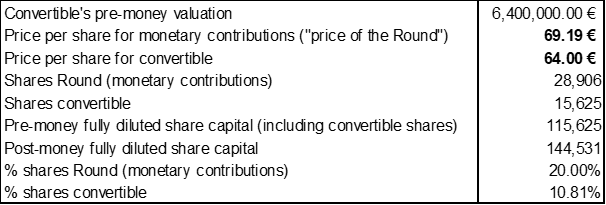

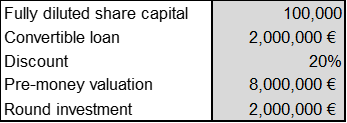

Discount on pre-money valuation when the weight of convertibles is higher: Let's finish with a radical example. What would happen if, instead of €1M, the company had received €2M in convertible loans?

Applying the discount directly to the pre-money valuation can lead to absurd scenarios in which the entry price of the convertibles is higher than the price paid by the round investors:

The pre-money valuation (€8M) and the convertible capitalisation price (€64) remain unchanged. As more shares are created (due to the higher amount of notes being capitalised), the pre-money fully diluted share capital is higher. As a result, dividing the same pre-money valuation by a larger number of fully diluted shares (131,250) reduces the price per share of the round to €60.95.

Again, the shares received by the round investors (31,250) represent 20% of the fully diluted post-money capital (164,063), but in this case, the convertible discount has been reduced and even has become negative: the lender pays a more expensive price than the round investor.

Osborne Clarke comment

The price per share created through the capitalisation of convertible notes shall be calculated by applying the discount to the price per share that investors will pay in the cash round.